Home Equity: Your Hidden Source of Wealth

Here’s how it works. When you own a home, you build up equity. Equity is the current market value of your home minus any remaining balance on your mortgage. Equity is wealth you build each time you make a mortgage payment, continuously chipping away at your loan balance.

At the same time, home values typically rise which drives up the overall value of your home.

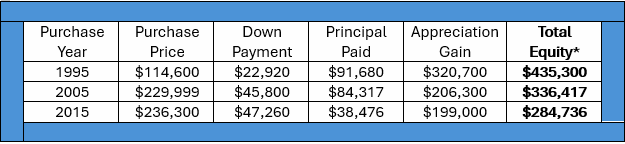

Here are some examples from Realtor.com:

Calculated early 2025

Your actual number will vary based on the purchase price, any improvements you have made to your house, the size of your original down payment, and more.

How Does Equity Benefit You if Selling Is on Your Horizon?

When the time is right for you to sell, your equity can give you flexibility to buy a more expensive home. Or to have more flexibility to price your home strategically and competitively to attract more buyer attention. Or, downsize and come away with a tidy profit.

If now is the right time for you to sell, but you are concerned about taking on a higher mortgage rate, your equity could cover a significant down payment. The more money you put down, the less you need to finance at today’s rates. Or, thanks to your equity, you may be able to buy your next house in cash. That has the added benefit of appealing to sellers otherwise concerned their buyer’s financing might fall through.

How Does Equity Benefit You if Selling is Not on Your Horizon?

A wise use of your home equity can include:

Home Improvements and Repairs. Fund remodels, additions, or emergency repairs such as HVAC or the roof. These improvements will increase the value of your home.

Education Costs. Finance college tuition or vocational training for yourself or your children.

Major Life Expenses. Cover weddings or medical bills or an item on your lifelist.

Start a Business. Use it as capital for a new venture.

Debt Consolidation. It may make financial sense to pay off high-interest credit cards or other loans with a single, perhaps lower-interest payment.

How Can You Access Your Equity?

A Home Equity Loan. A second mortgage providing a lump sum at a fixed interest rate, repaid over time.

A Home Equity Line of Credit [HELOC]. A revolving line of credit, similar to a credit card, with a variable rate, offering flexibility for ongoing expenses.

Cash-Out Refinance. Replace your current mortgage with a larger one, receiving the difference in cash while getting a new interest rate and term.

Make It a Wise Decision.

Remember these considerations:

Risk. You will be using your home as collateral. If you can’t pay, you risk foreclosure.

Costs. Loans involve fees [origination, appraisal].

Tax Deductibility. Interest might be tax-deductible if used for home improvements. Check with your tax preparer.

Consult with your financial advisor or your lender to evaluate whether using your equity for the purpose you have in mind augments your long-term wealth creation goals.

To find out the current market value of your home, consult with a realtor who can help you understand current value given current market conditions. You can also hire an appraiser, and in doing that be sure the appraiser understands your purpose in determining current market value, as appraisers use different techniques depending on the purpose of the appraisal.

As a friend, family member, or former client, I am always happy to prepare a current market evaluation of your home at no cost or obligation on your part. Doing so benefits me as well as providing clarification to you. As I look at the market from the point of view of your property, I always gain understanding of the market, an understanding I am always eager to further.

If your home is not located in the high country, I am also glad to help find a competent realtor in your area.

A Final Thought, about Insurance.

If it’s been a while since you purchased your home, your home almost inevitably is worth more than you paid for it. In this area, homes purchased prior to 2020 most likely are selling currently at twice that value. For that reason, knowing your home’s current market value is important for insurance purposes. Should your insurance policy be based on replacement value and should it be destroyed, you’ll want a replacement amount equivalent to current market value, not original purchase price.

Insurance companies have methods to calculate current market value but the knowledge you bring to that consideration can be important as well.

Along that line, when you do improvements to your home, be sure to let your insurance agent be aware of the improvements.

If the improvements are work that requires a permit, check on down the road that the information on your tax records reflect the improvements.